Chapter four | Energy

Introduction

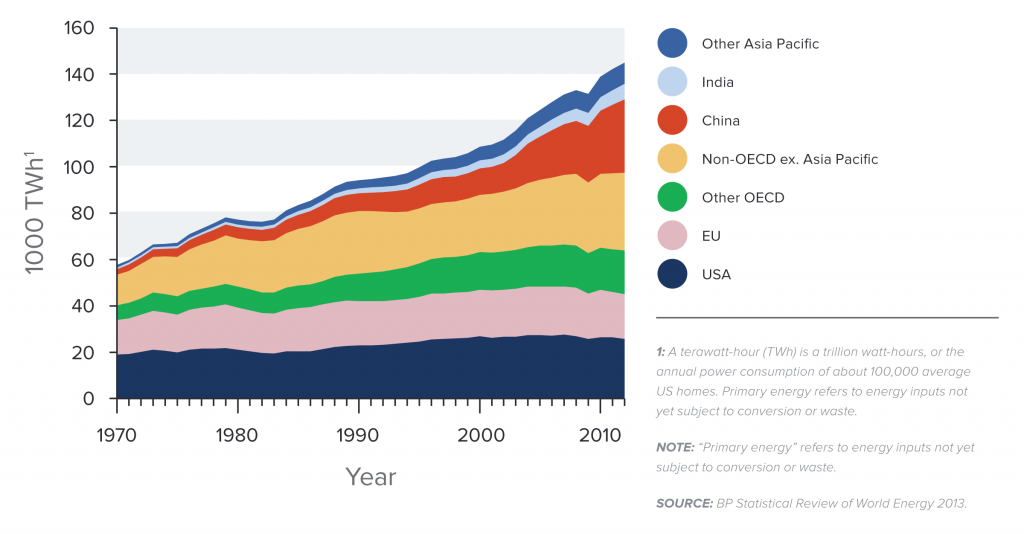

Energy is vital to modern economies: for industry, transport, infrastructure, information technology, building heat and cooling, agriculture, household uses and more. Any nation that wants to grow its economy and improve living standards must secure a robust energy supply. As incomes rise, so does energy use: high-income countries consume more than 14 times as much energy per capita as Least Developed Countries, and seven times as much as lower-middle-income countries. 1 As more countries rise out of poverty and develop their economies, energy demand will rise with them, putting pressure on local supplies as well as global energy systems.

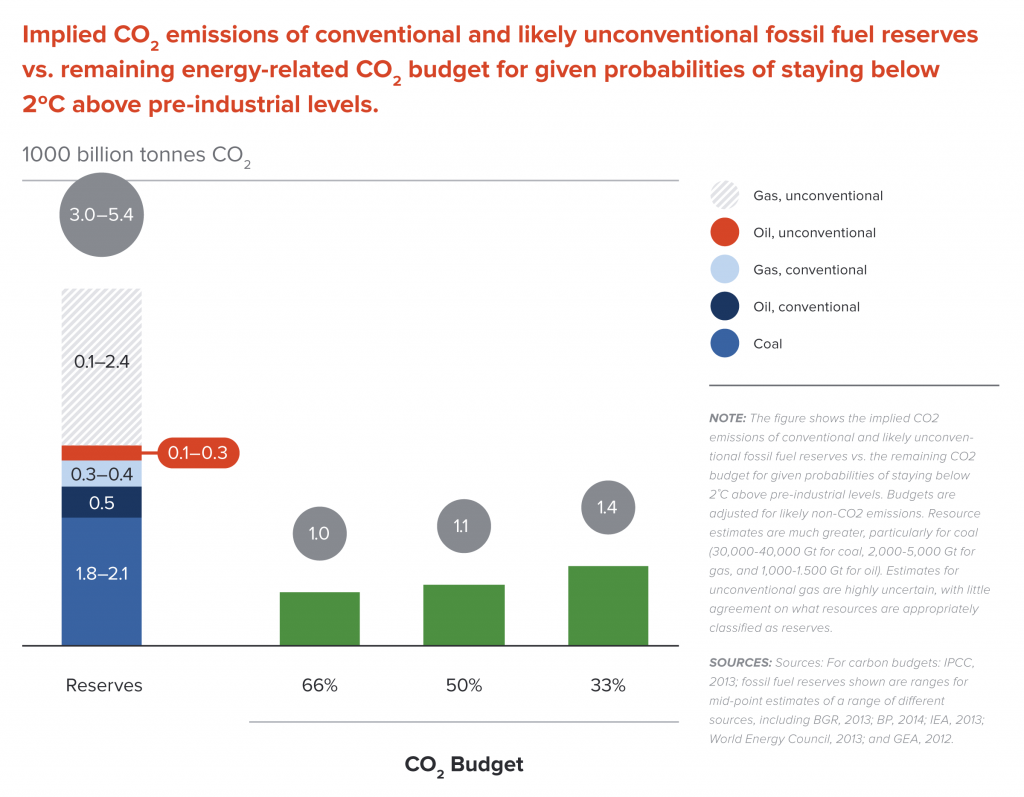

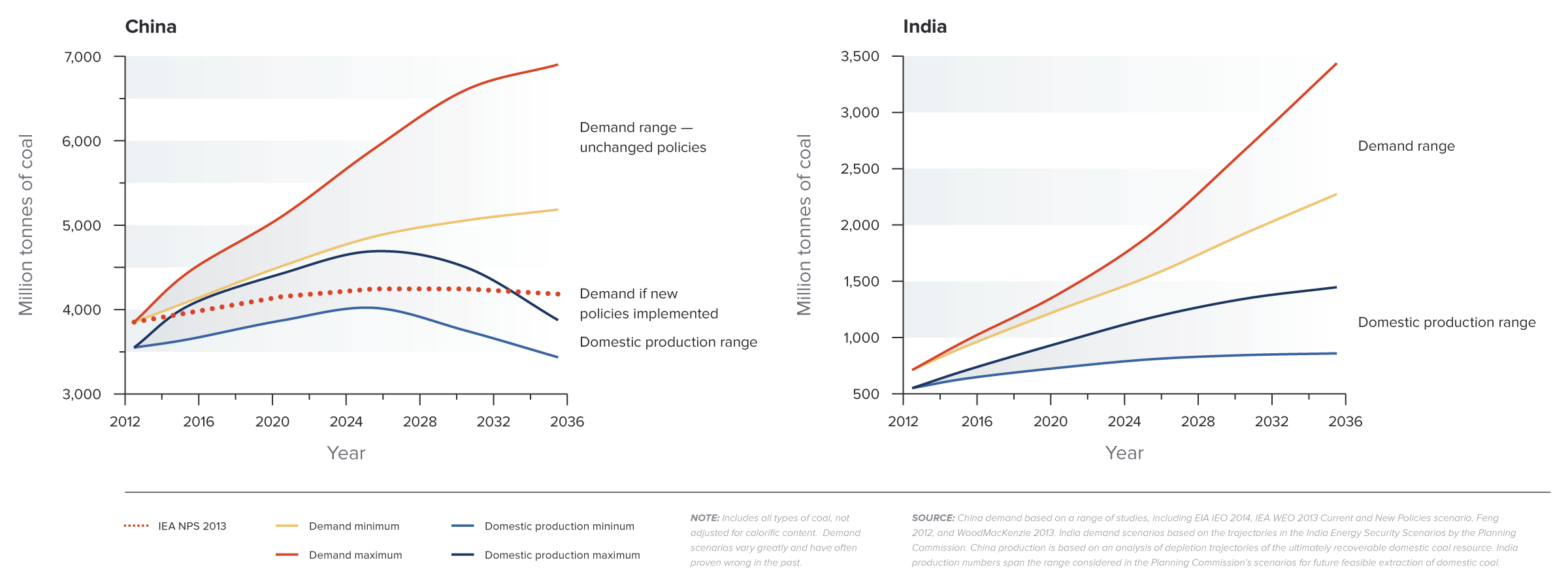

Energy is costlier, prices are more volatile, and for several fast-growing countries, supplies are now also less secure. There is a need to reconsider which energy options are lowest-cost and “safe bets”; the advantages of coal in particular have been eroded as large, fast-growing economies find their domestic supplies cannot keep up with demand, some regions have seen low-cost gas emerge as an alternative, and many grapple with air pollution and other social costs. Reducing coal use is also crucial to reducing climate risk.

Responding to these new challenges will require a multi-faceted approach. One key task is to increase resource efficiency and productivity – to make the most of our energy supplies. Some countries have already made significant gains in this regard, but there is much untapped potential. Innovation also is expanding our energy options: from the revolution in unconventional gas and oil, to the rapid growth of renewable energy resources, most notably wind and solar power. In many countries, falling costs are already enabling renewables to become a mainstay of new energy supply. Maintaining the speed of innovation will further expand these opportunities.

A massive wave of energy infrastructure investment is coming.

Policy-makers face crucial choices in the next few years. A massive wave of energy infrastructure investment is coming: to keep up with development needs, around US$45 trillion may need to be invested in the next 15 years.2 This gives countries a chance to build robust, flexible energy systems that will serve them well for decades to come, but it also represents a critical window to avoid locking-in technologies that expose them to future market volatility, air pollution, and other environmental and social stresses. Investing in energy efficiency and low-carbon technologies may increase upfront costs, but it will also bring multiple benefits.

This chapter explores key issues for energy systems in countries at different stages of development. We start by noting major energy trends around the world, then take stock of “seeds of change” that may offer opportunities for countries to strengthen and diversify their energy systems and improve productivity. We also assess some of the barriers to change, which can be considerable, and discuss ways to overcome them, which may require new decision-making frameworks, business models and financing arrangements. Like major changes in the past, transforming energy systems will require deliberate effort. We end the chapter by identifying concrete steps that can be taken in the next 5–10 years.

Energy is a broad topic, and our analysis is not comprehensive. While we discuss other sectors, we give priority to electricity production, which is crucial to economic growth, is increasing rapidly, and offers significant near-term opportunities for improvement. Most models for mitigating climate change also agree that the electricity production has the largest potential for rapid reductions in energy-related CO2 emissions, while decarbonising other sectors will be slower. 3

Key energy-related issues are also covered in other chapters. Chapter 2: Cities examines how more compact urban forms can reduce energy use, especially for transport; Chapter 3: Land Use and Chapter 7: Innovation both discuss biofuels, and Innovation examines how policy can support and accelerate technological advances that could fundamentally change energy consumption and supply patterns. Chapter 5: Economics of Change addresses the role of carbon pricing and the need to reform fossil fuel subsidies, and Chapter 6: Finance looks at stranded-asset risks and at ways to reduce financing costs for low-carbon energy.

Better Growth, Better Climate

Better Growth, Better Climate